Custom insurance software development

Specific needs. Different goals. Unique pain points. Every business has different requirements. The requirements off-the-shelf software solutions can’t meet. This is where custom insurance software development steps in.

Artificial intelligence. Machine learning. Big data. Robotic process automation. Blockchain. Our insurance software solutions are powered by innovative technologies.

Results? Affordability. Efficiency. Speed. Accessibility. User-friendliness. At Vega IT, we co-create InsurTech software that works for you. Not the other way around.

The state of insurance in 2025: Customer experience as ...

With global IT spending set to reach $362 billion in 2025, the insurance industry is undergoing a major shift toward cutting-edge technologies. What does this mean for IT adoption in insurance, and what key steps should co...

Passion. Proactivity. Expertise.

You have passion and ideas for innovating your insurance business. We bring the brains and experience to make them true. Whether you need to spin your in-house capability or hire an entire InsurTech software development team, we match your ambition and drive your success.

For insurance companies

Insurance companies. Insurance brokers. Insurance carriers. We help you integrate the latest insurance software solutions into your business processes. The goal? Streamlining operations, meeting evolving customer needs, and driving innovation.

For InsurTech companies

InsurTech software development. Infrastructure management. Scaling your operations. Our experienced InsurTech software development team provides the expertise and support your business needs to succeed.

Book a call

The insurance software solutions we can help you with

Phone apps. Auto-monitoring devices. Wearable technology. Those are all pieces of insurance tracking software, helping people get insurance in a matter of minutes. No need for human interaction and tiresome documentation. Here is what we can help you with:

System integrations

Our team can help you integrate your InsurTech solutions with other systems. These include CRM tools or accounting software – anything that streamlines your operations and improves efficiency.

Policy management software

We help you implement insurance policy management software that enables your customers to conveniently view and manage their policies online.

Insurance claims software

Implement tools for automated claims processing in insurance with our help. Reduce manual errors and accelerate the claims process for your clients.

Insurance data analytics

Gain insights into customer behaviour. Identify the hottest trends. Make informed business decisions. How? By harnessing the power of data analytics.

Customer experience software

Enhance your customer experience and increase engagement by implementing chatbots, personalized pricing, and other innovative features that align with the expectations of today's digital customers. Streamline policyholders’ experiences by providing self-service – 24/7 customer service, automated claims processing, etc. All in one place, without the need to contact customer support.

Online and mobile-enabled digital services

Transform your existing value chain. Let customers quickly explore, understand, and purchase products with minimal hassle. Provide them with a more accessible and affordable experience that leads to increased sales.

Insurance software compliance

We implement robust security protocols and data privacy measures to make sure your software solutions comply with the industry’s strict regulatory requirements.

Smart contracts

Automating the claims process. Reducing the risk of fraud. That’s what you can achieve by implementing smart contracts using blockchain technology.

Fraud detection

We can help you implement fraud detection tools, using AI and machine learning algorithms. Detect and prevent fraudulent claims. Protect your bottom line and maintain customer trust.

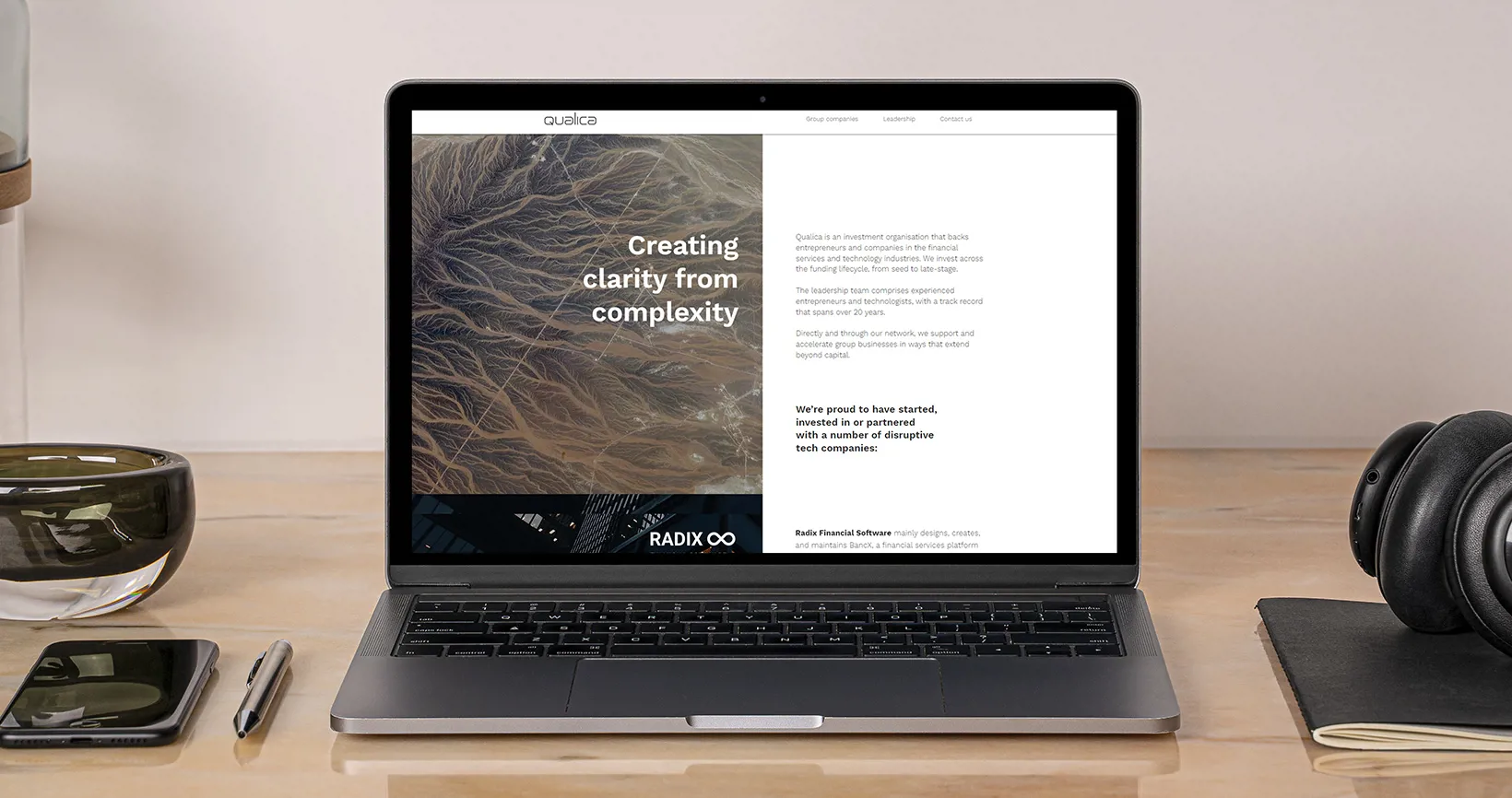

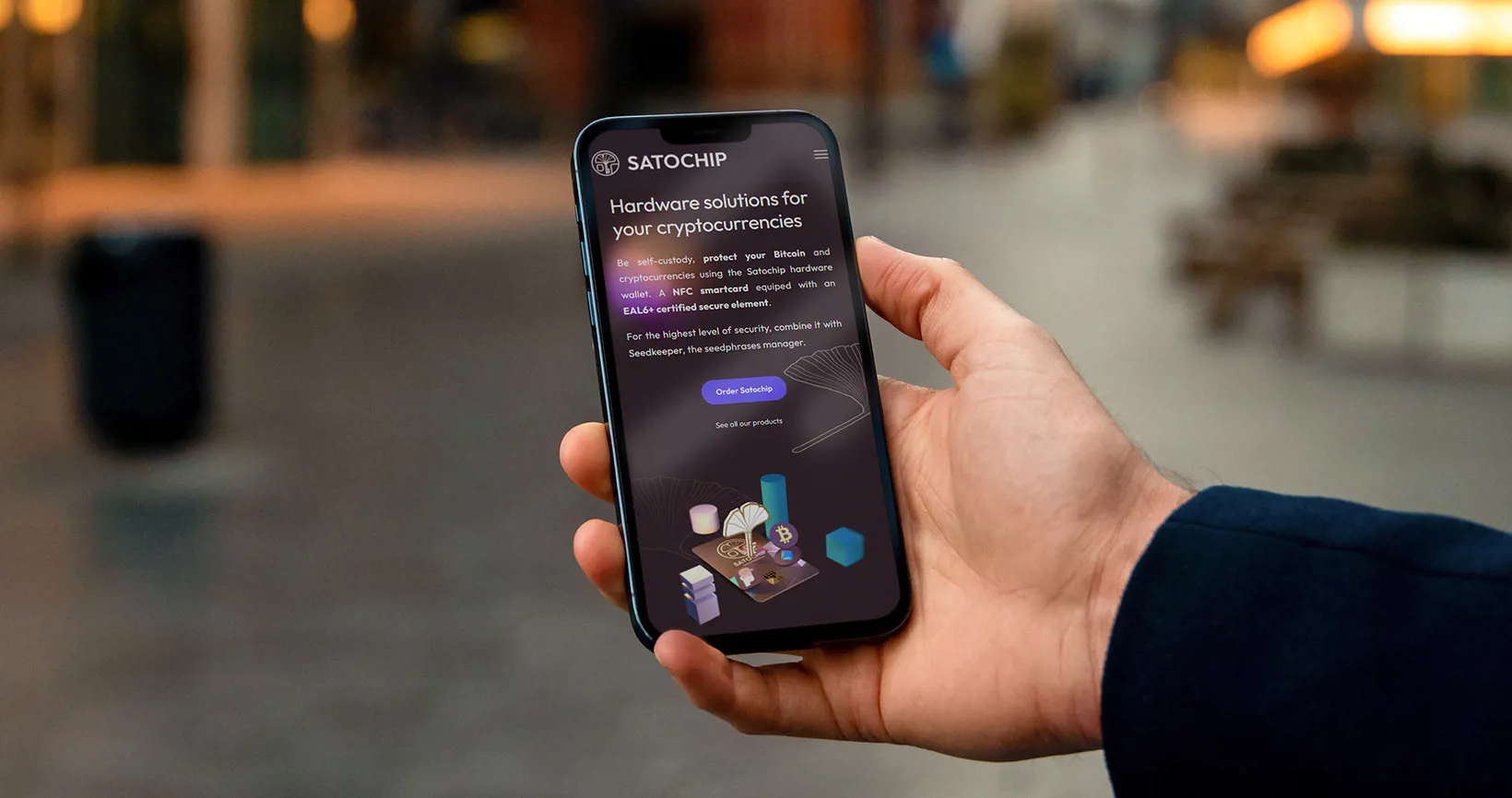

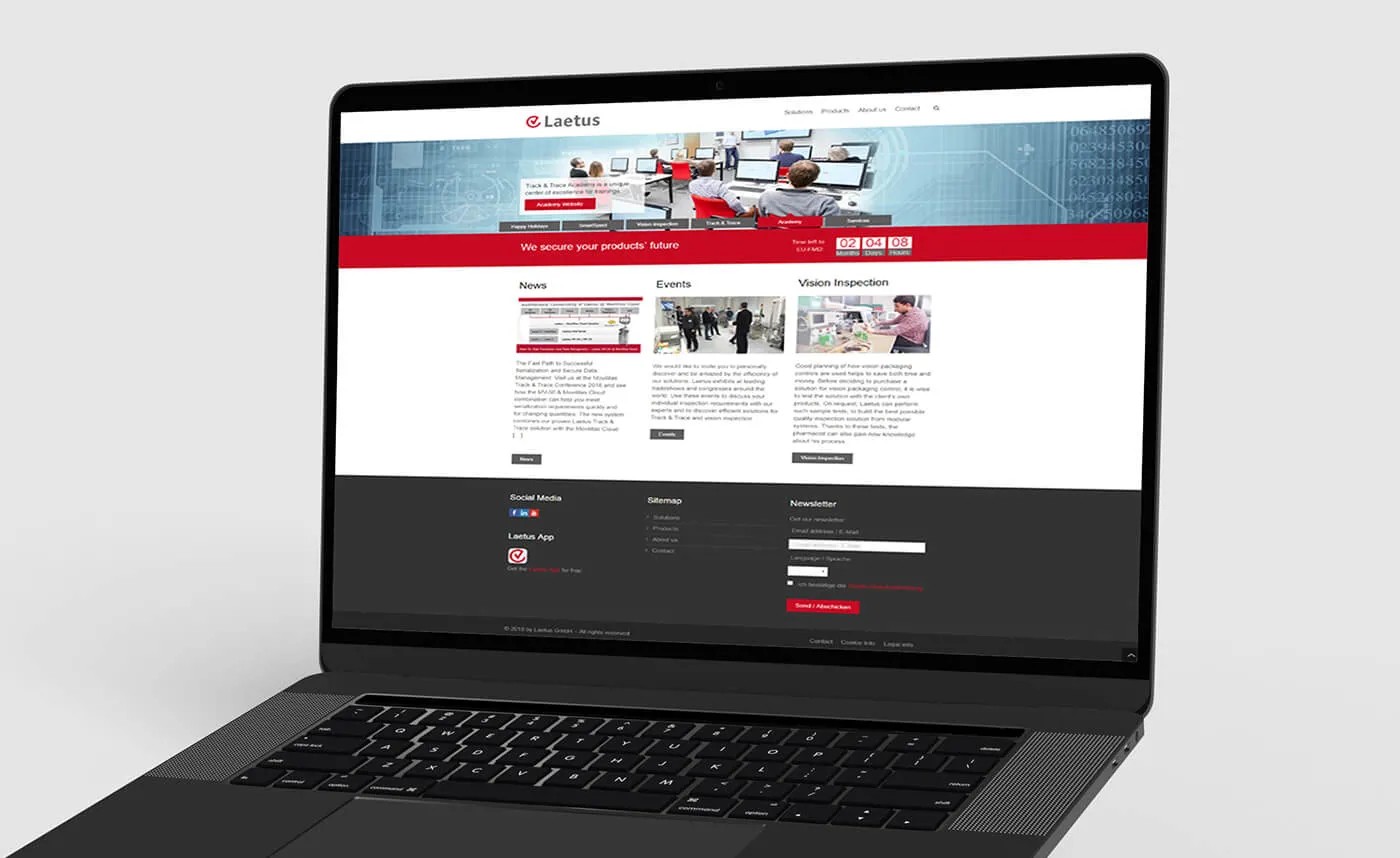

What we have done for our customers

With over 1000 successfully delivered projects across Europe, USA and UAE and clients that are choosing to work with us for years.

Our workWhat else can we help you with:

A comprehensive guide to product discovery

How to prevent huge financial losses when building your product?

It’s all because of the sound and proven discovery process. Whether you’re exploring a third-party solution or want to build something from scratch, validation is incredibly important.

Download the free guide

Avoid common pitfalls in validating your product ideas. Whether you’re an aspiring entrepreneur, an early-stage startup, or an investor–you’re not immune to making mistakes, which is why it’s useful to acknowledge them in advance. Download the guide and learn more on how to validate your product ideas

And we’ve won some big awards for our work

Which business model suits you?

Different budgets, deadlines, challenges, and requirements. There is no one-size-fits-all approach to software development. To match your exact goals and ambitions, we offer two types of business models:

- Time & material: Greater control. Flexibility. Participation in candidate selection. With no rigid processes or end dates, this business model is easier to scale up or down as your business needs change.

- Fixed price: Fixed scope. Fixed budget. Fixed timeline. Those are the main benefits of the fixed price model. You set the requirements upfront, and we deliver the project within them.

Many clients choose to start with the fixed-price model. However, as their project scope evolves, they typically shift to the time & material model.

We’re here to find fast, elegant solutions to your trickiest problems.

Get in touchStrength in numbers

Richard’s relentless passion for innovation delivers digital, commercial and organisational growth for our clients. He joins Vega IT from IBM where he was an Executive Partner shaping digital change programmes. As a multi-award-winning digital business transformation consultant with 30 years of experience, he’s highly experienced at helping organisations define and deliver their technology enabled transformation programmes.

Richard Morris

Executive PartnerSend us your contact details and a brief outline of what you might need, and we’ll be in touch within 12 hours.

Insurance software development – FAQ

Want to learn more about insurance software development services? We’ve answered some of the most frequently asked questions for you.

InsurTech, or insurance technology, is a rapidly growing sector that is transforming the insurance industry. InsurTech companies use innovative technologies and business models to offer new products and services that improve the efficiency and speed of business processes.

From digital policy management tools to claims processing software, InsurTech solutions are designed to meet the needs of today's digital customers and provide them with a seamless, personalized experience.

When you search for the best InsurTech software development partner, you should choose the company with technical expertise, deep sector knowledge, and relentless passion.

To be sure you selected the right partner, this is the homework you need to do in advance:

- Define your vision and goals

- Make a list of potential software development partners

- Check their technical expertise and domain knowledge

- Validate their language proficiency and whether they are a cultural fit

- Ask for references and case studies

- Make a shortlist

- Negotiate terms and pricing

Performing research. Running a scoping session. Building the system’s architecture. Software development. Testing the product. The launch. Insurance software development services are indeed a multi-step process that needs to be executed strategically.

The price of insurance software development depends on a range of factors. Do you want us to optimise your existing InsurTech software solution or create innovative end-to-end insurance software for you? Do you need an automated underwriting system, healthcare policy management software, or maybe reinsurance software solution?

At Vega IT, we take time to get to know your business — your dreams, needs, hopes, and challenges. We create the solution that works for you. In the long run.

Our InsurTech experts have strong experience in developing a wide range of insurance software solutions. Some of them are: policy management software, underwriting software, CRM software for insurance, accounting software for insurance agents, CCC software, insurance fraud detection software, reinsurance broker software. We co-create custom insurance software that fully meets the requirements of your business. Want to learn more about our experience in insurance software development? Take a look at your case studies.