IPR deadlines are here: How banks and fintechs can adapt to instant payments

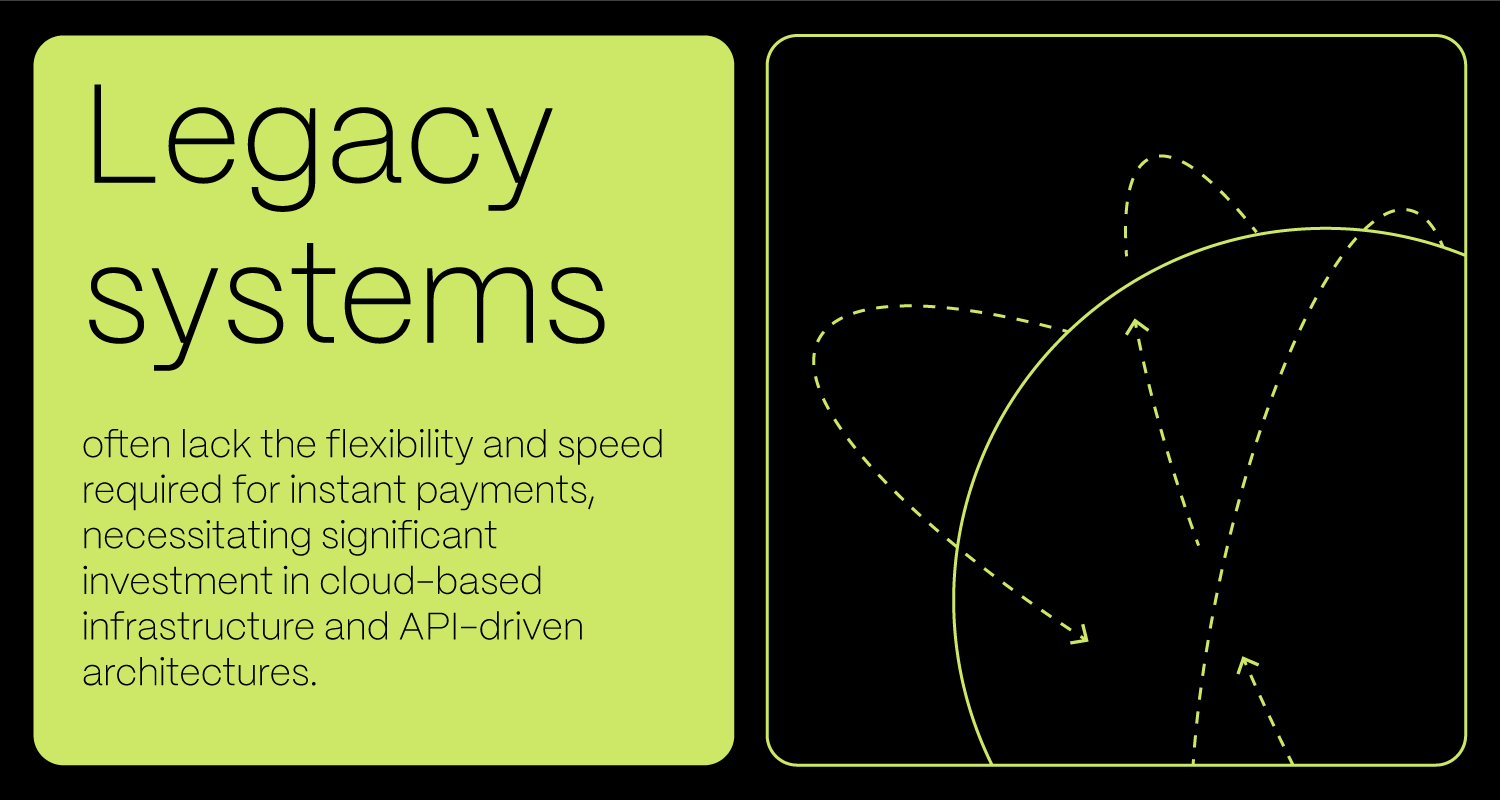

The European Union’s Instant Payments Regulation (IPR) is poised to transform the payments landscape by making instant payments the new norm for euro-denominated transactions. This initiative aims to foster financial inclusion and accelerate innovation across the region. The key deadlines for it are January 9 and October 9, 2025.

What challenges, risks, and opportunities does IPR bring to banks and fintechs? Let’s explore.

Understanding the EU Instant Payments Regulation

By January 2025, all PSPs in Euro Area member states had to ensure they can receive instant payments by enabling instant payment functionality for all customers and implementing fraud and prevention mechanisms. One such example is Confirmation of Payee (CoP), a security measure that verifies whether the name on a bank account matches the details provided by the payer before proceeding with the transaction.

Next, by October 2025, they must also enable the capability to send instant payments, ensuring round-the-clock availability, affordability, and security. That is when additional mandates will also come into force.

For example, sanction screening compliance is the process of checking transactions against international sanctions lists to ensure that financial institutions don’t engage with restricted entities. Fee transparency, the process of transparently disclosing all costs associated with financial services, will also take effect.

However, while users will enjoy faster, more reliable payments, the implementation of IPR comes with significant operational, technical, and compliance challenges for banks and fintechs.

PSPs now must revamp their systems, processes, and risk management frameworks to meet these ambitious requirements, all while keeping services cost-effective. The regulation represents a double-edged sword – a driver of innovation but also a test of resilience and adaptability for Europe’s payment ecosystem.

Unlocking new opportunities for banks and fintechs

The Instant Payments Regulation provides fertile ground for growth across various segments. Statistics prove the same.

For example, McKinsey estimates that the number of instant-payment transactions in the European Union will increase from around three billion today to almost 30 billion by 2028, an average annual growth rate of 50%.

For banks and fintechs, this is not only an opportunity to enhance user experience but also to develop new services and streamline existing processes. They can do that in several ways:

Cross-border payments

Instant payments reduce the friction and delays traditionally associated with international transfers, enabling businesses and consumers to send and receive funds across borders in seconds. This can benefit e-commerce platforms, global supply chains, and remittance providers.

For banks, offering fast and cost-effective cross-border payments strengthens their value proposition to corporate clients, especially small and medium-sized enterprises (SMEs) looking to expand internationally.

Fintechs, on the other hand, can leverage their agility to develop innovative cross-border payment solutions, such as multi-currency wallets and real-time foreign exchange (FX) services.

Treasury management

Real-time payment capabilities can enhance accounts receivable (AR) and accounts payable (AP) processes by improving cash flow visibility and reducing settlement times.

For corporate treasurers, instant payments provide an opportunity to optimize liquidity management. For example, businesses can pay suppliers just in time, reducing the need for working capital. Banks can tap into this demand by offering real-time liquidity monitoring tools and tailored treasury solutions.

Payouts, refunds, and payroll

Real-time payment capabilities can significantly facilitate payouts, refunds, and payroll, enabling businesses to offer faster and more reliable services.

For instance, merchants can issue instant refunds to consumers, enhancing customer satisfaction and loyalty. Similarly, employers can ensure timely payroll disbursements, even in scenarios requiring last-minute adjustments.

This is an immense opportunity for fintechs, too. They can offer scalable APIs that integrate seamlessly with businesses’ payment systems and can cater to high-frequency payout needs, such as gig economy platforms, ensuring that workers receive earnings instantly.

Consumers and retail

In the retail space, instant payments enable more immersive consumer experiences, such as faster checkouts and enhanced loyalty programs. For consumers, the ability to make and receive instant payments provides unparalleled convenience and reliability, fostering greater trust in digital financial services.

Fintechs specializing in P2P payments and mobile wallets stand to benefit as real-time payments become the norm. Banks, too, can enhance their retail offerings by integrating instant payments into mobile apps and online banking platforms, driving adoption and engagement.

The challenges of complying with IPR

Despite its potential, the IPR poses significant challenges for banks and fintechs. Overcoming these hurdles will require strategic investments and innovative thinking. Key challenges include:

Technological upgrades

Legacy systems often lack the flexibility and speed required for instant payments, necessitating significant investment in cloud-based infrastructure and API-driven architectures. That is precisely why it is crucial for banks and fintechs to upgrade their core systems to handle real-time transactions, ensure 24/7 availability, and comply with new interoperability standards like SEPA Instant Credit Transfer (SCT Inst).

Banks should also leverage innovative technologies, such as artificial intelligence, to optimize transaction routing and detect anomalies in real time, ensuring seamless performance during high transaction volumes.

For them, meeting these regulatory deadlines will put significant pressure on resources and require careful, strategic planning.

Fraud prevention and risk management

Instant payments increase the risk of fraud due to the speed and irrevocability of transactions. PSPs must invest in cutting-edge fraud detection systems, such as AI-driven transaction monitoring, which can identify suspicious patterns and flag potential fraudulent activities in real time.

Machine learning algorithms can also enhance predictive analytics, enabling PSPs to preemptively mitigate risks. Additionally, implementing robust identity verification tools, such as biometric authentication and blockchain for transaction traceability, can further bolster fraud prevention efforts.

Liquidity management

The 24/7 nature of instant payments requires real-time liquidity management, placing pressure on banks to maintain sufficient reserves. To address this, banks need advanced treasury management systems that offer real-time balance forecasting and liquidity optimization.

AI-powered tools can analyze transaction flows to predict liquidity needs and optimize reserve allocations. For smaller banks and fintechs, especially during peak transaction periods, automated intra-day liquidity adjustments can ensure operational stability and reduce the risk of liquidity strain.

Compliance costs

Adhering to IPR requirements, such as sanction screening and fee transparency, involves significant compliance costs. PSPs adopt advanced compliance tools that integrate AI and machine learning to automate sanction list screening and ensure real-time processing. These technologies can significantly reduce manual errors and speed up compliance checks.

Furthermore, implementing transparent fee structures through dynamic pricing models and AI-driven fee analytics can help PSPs maintain profitability while adhering to regulatory requirements.

For PSPs, it is extremely important to balance these costs with the need to keep instant payment services affordable for users.

Customer education

Educating customers about the benefits and limitations of instant payments, such as their irrevocability, is critical. Banks and fintechs must deploy interactive digital platforms and AI-powered chatbots to guide users through the instant payment process and address common concerns.

Personalized education campaigns leveraging data analytics can help target specific customer segments, ensuring that users understand the implications and benefits of instant payments, thereby reducing dissatisfaction and enhancing trust. Misunderstandings or lack of awareness could lead to user dissatisfaction or increased risk of fraud.

Wrapping up

IPR is a transformative milestone for Europe’s payments ecosystem, driving faster, more reliable services for users while presenting substantial challenges for banks and fintechs.

To succeed, PSPs should now focus on embracing innovation, investing in robust infrastructure, and addressing compliance proactively. Emerging technologies like AI and machine learning will play a key role in addressing technical and operational challenges. And, finding the right technology partner with both technical and payment domain expertise is essential for PSPs to navigate the challenges of IPR.

Contact us and learn how we can help in the process.