Why system integrations are the key to modern insurance success

For years, the insurance industry operated on manual processes like endless phone calls, paper forms, emails, and managing unstructured data. While those old-school methods were getting the job done, they were far from efficient. In reality, they slowed down teams, making seamless communication almost impossible.

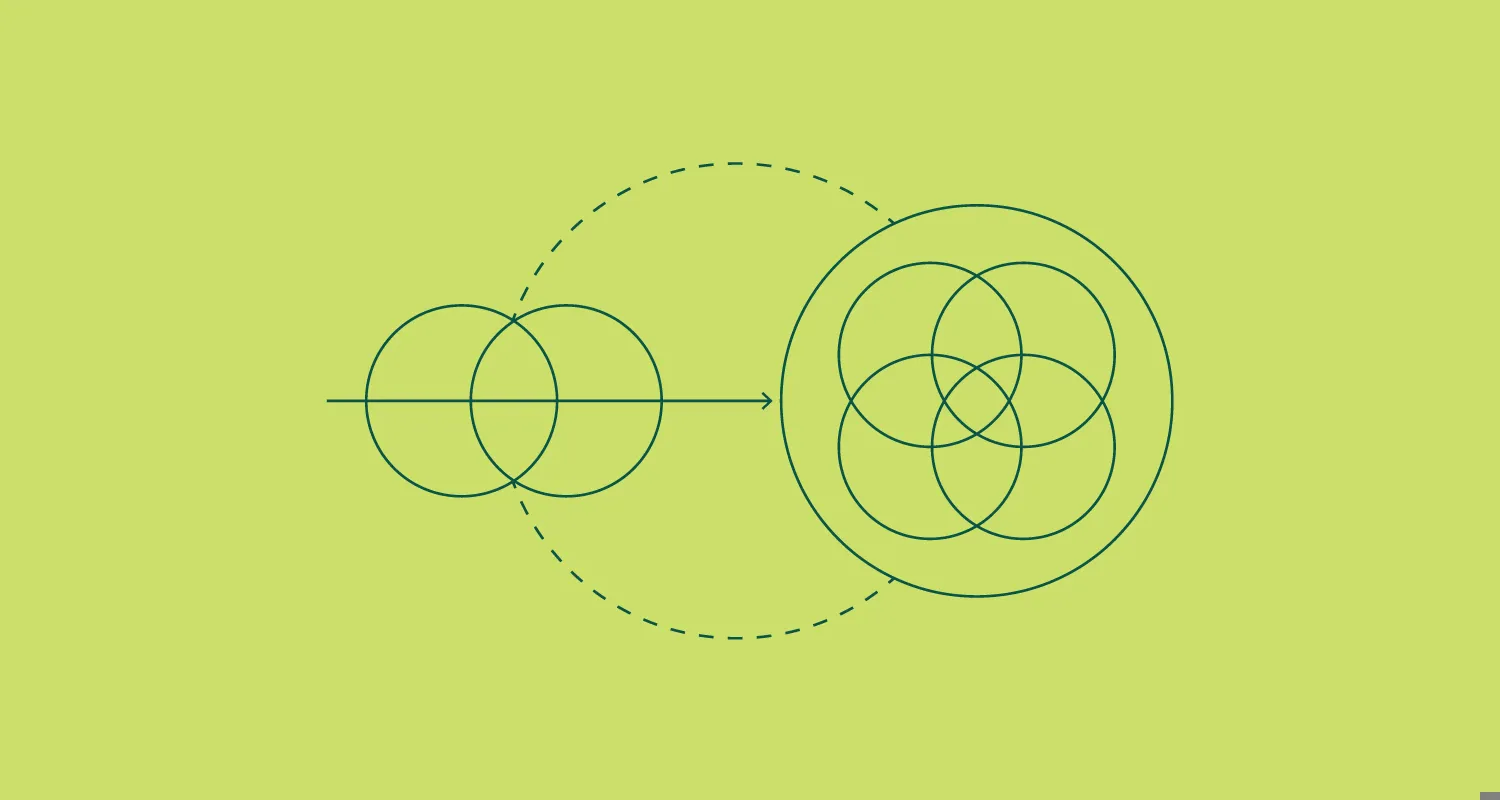

We see that many insurance companies still rely on software products that are not connected, which creates silos and limits data accessibility. So, while the industry has been adapting to digitising its processes, it still has a long way to go to achieve true digital transformation.

We believe that, just like in other traditional industries like finance, system integrations should be crucial for insurers who want to future-proof their businesses through innovations.

The goal shouldn't be just to connect the tech but to:

- build a solid foundation that will boost operational efficiency;

- keep all participants in the chain happy;

- ensure compliance with industry regulations.

The role of system integrations in insurance

While the benefits of system integrations might seem obvious, it’s not until we dig deeper that their true impact on the insurance industry becomes clear.

Here are a few key ways how system integrations are reshaping the industry for the better:

Eliminating fragmented systems and reducing errors

Managing customer data across multiple, disconnected systems is forcing employees to manually re-enter information into each platform. This process is painfully time-consuming, and it's also a breeding ground for errors like duplicated records, missing details, and inconsistencies in data. All of those undermine trust in the data not only by the employees, but the clients as well.

Here, system integration is changing the game. By seamlessly connecting these fragmented systems, data can flow freely and more accurately across platforms. No more duplicate entries, no more second-guessing in the validity of data. Integrated systems eliminate the cracks that data used to fall through, giving insurers a solid foundation to build on.

All resources are available at one’s fingertips, and with quick access to information, everyone involved in the process can make more informed decisions that increase both efficiency and the customer experience.

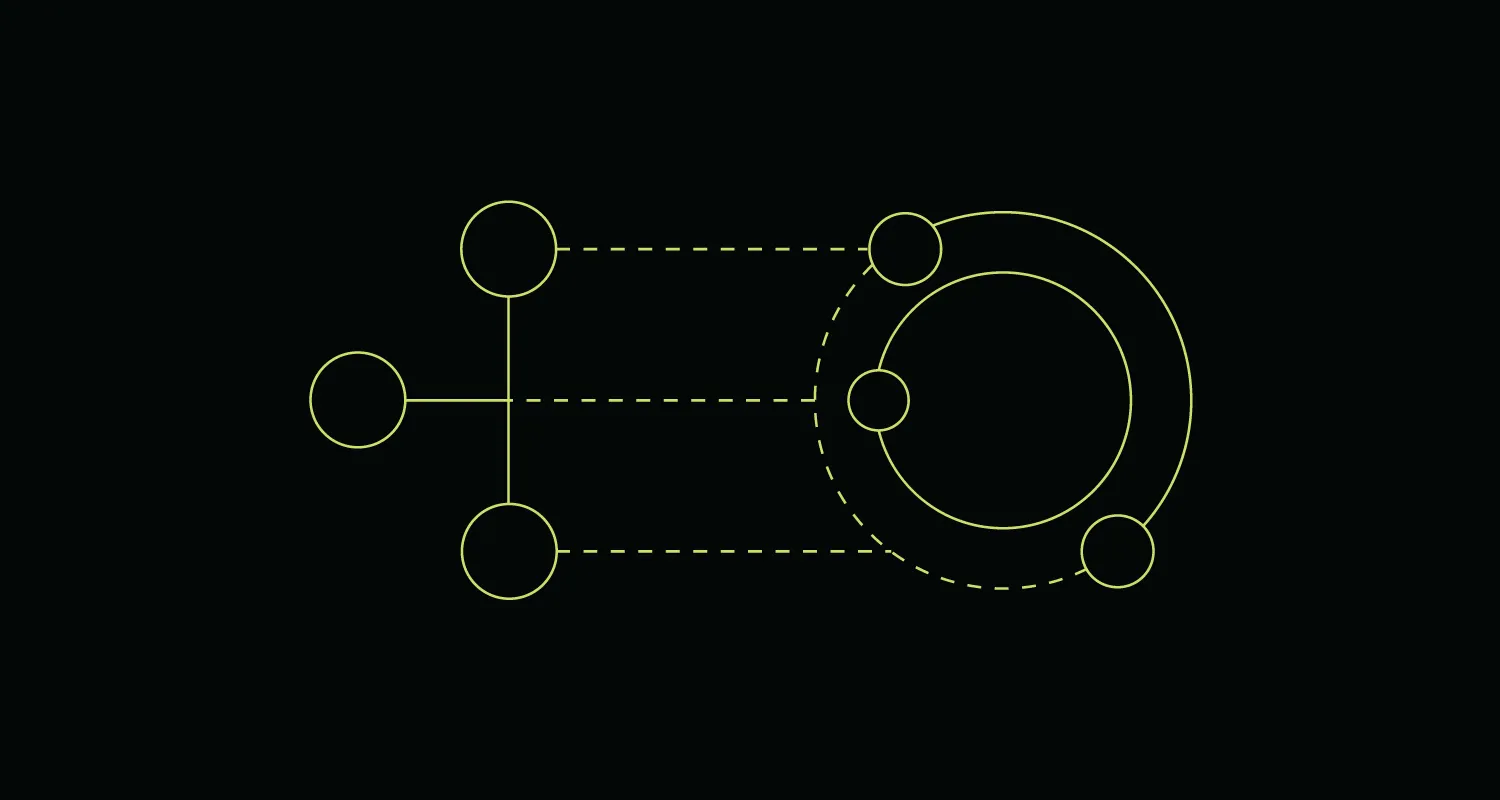

Let’s compare fragmented and integrated systems:

|

Key areas |

Fragmented systems |

Integrated systems |

|

Data accuracy |

High risk of errors and inconsistencies. |

Reliable, consistent, and up-to-date data across the organisation. |

|

Operational efficiency |

Time-consuming manual processes. |

Streamlined workflows with minimal input. |

|

Decision-making speed |

Delayed due to the lack of access to centralised, reliable data. |

Faster decisions are supported by seamless access to data. |

|

Customer experience |

Unreliable, slow, and complicated systems can frustrate and impact your customer trust. |

Faster and efficient service delivery improves customer satisfaction. |

|

Compliance |

Challenging to track and verify data increases the risk of non-compliance. |

Easier compliance with centralised, traceable data. |

|

Operational costs |

High costs due to inefficiencies and errors. |

Lower costs through reduced inefficiencies and errors. |

|

Team collaboration |

Silos between departments lead to poor communication. |

Connected systems enable smooth communication and improve teamwork. |

|

Data security |

Harder to secure with vulnerabilities in disconnected systems. |

Stronger security through centralised data management. |

|

Scalability |

Harder to scale systems that are not integrated. |

Supports scaling without added complexity or inefficiencies. |

|

Future-readiness |

Difficult to implement advanced technologies with scattered data. |

Enables the use of AI, machine learning, and other advanced tools to differentiate from competitors. |

Automating processes for greater efficiency

Automation is the backbone of efficiency in modern insurance, and it all begins with integrated systems. They enable insurers to meet market demands, scale efficiently, and stay ahead in an industry that relies on speed and precision. In an open market like Loyd's, automation isn't just a convenience. Instead, by connecting siloed systems, insurers can eliminate manual processes, reduce human errors, and create workflows that are not just faster but smarter as well.

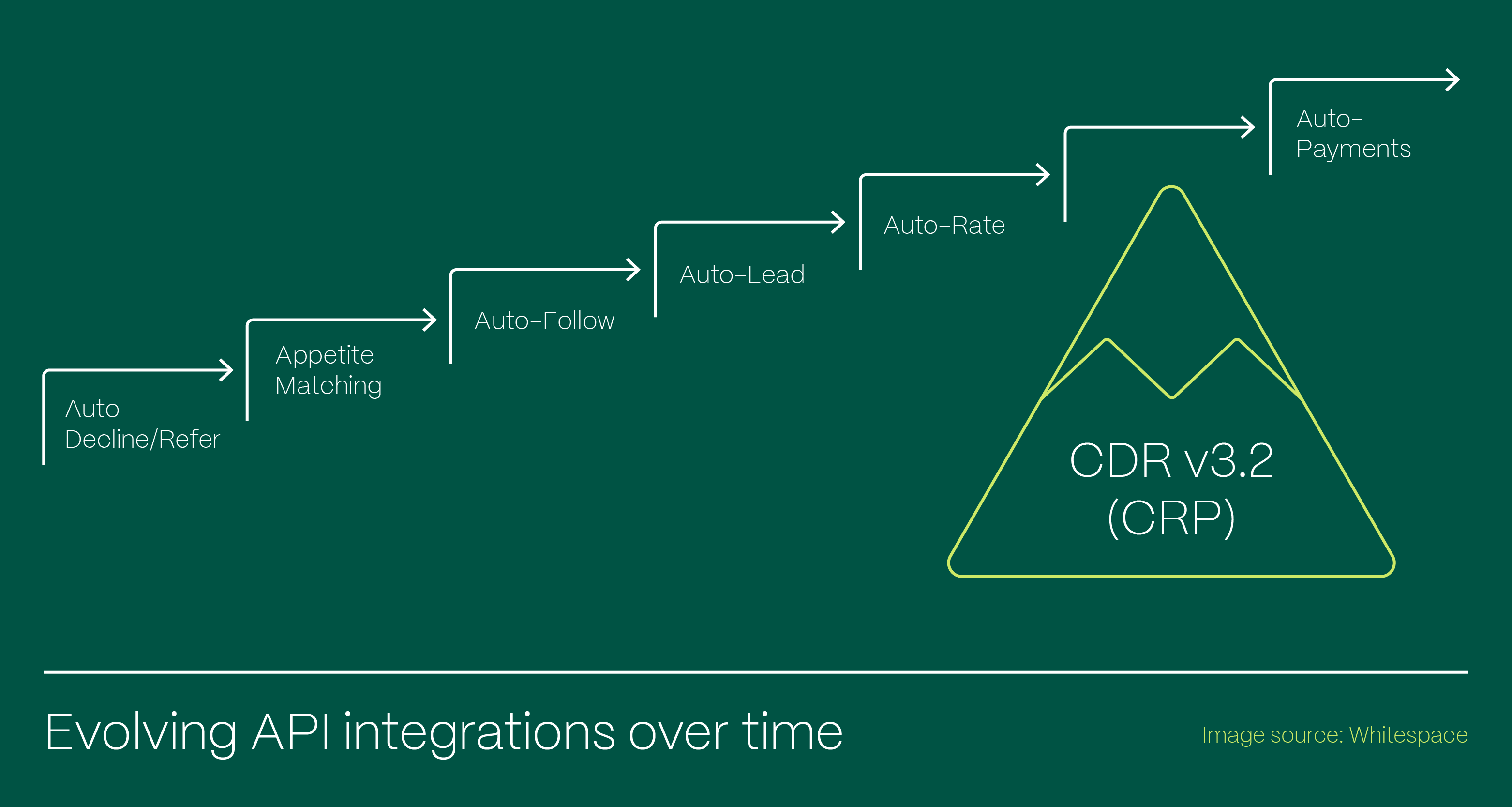

In the article APIs in speciality insurance, our partners at Whitespace offer excellent examples of how automation is transforming the specialty insurance landscape:

A simple, initial implementation for brokers and underwriters might be to extract written and signed line information and feed this into a data warehouse to assist with portfolio analysis. A next step for underwriters could be to examine a couple of key elements in the contract to determine whether they are out of scope and automate a decline, or flag for referral, with a reason to direct the underwriter when they come to review the risk. Examples of data used to drive rules are risk location and/or limits, as well as generic checks on items such as inception date. Whilst this is an underwriter implementation, it will provide brokers with a quicker response, and will ultimately lead to a better service to customers. By working together, brokers and underwriters can build more elaborate automations, such as appetite matching. Appetite matching is where an underwriter builds rules against the structured data within the contract to then automate guidance to brokers in an unsolicited manner. Brokers can control from whom to receive this unsolicited feedback and also implement the underwriting rules for their own in-house facilities and MGAs, to help maximise the usage of these placement vehicles. Automation of follow lines can also be achieved with a relatively small amount of data, compared to that needed for a full CDR record. This will speed up the placement process on risks with automations in place and frees up underwriter time to focus on more complex risks. As data sets grow, integrations can be built to PAS systems, to minimise/avoid having to re-key information. The addition of insurable interests opens up automated ratings and the option to transfer information to data and analytics platforms.

As you can see, automation through integration is not about replacing human expertise but empowering it.

Centralised data for business insights

In a data-driven world, centralised information can be the difference between thriving and merely surviving. With integrated systems there are no more scattered spreadsheets, disconnected platforms, or fragmented insights. Instead, it ensures that every decision insurers make is based on accurate, up-to-date information.

Now, with all data in one place, advanced analytics also become possible.

Insurers can utilise predictive modelling to:

- anticipate customer needs;

- assess risks with precision;

- refine offerings based on actionable insights.

Let’s look into portfolio analysis. For insurers that harness the power of integrations, the process becomes less about guesswork and more about gaining strategic clarity as it enables companies to identify trends and make smart business decisions.

To put it simple: When data flows seamlessly, so does success. That’s the power of integration.

Ensuring compliance and meeting regulatory standards

Frameworks like Blueprint 2 at Lloyd’s are pushing for standardisation and interconnected systems, and what insurers see is that the pressure to keep up has never been greater.

That’s why leading insurers use integrated systems try to stay ahead of the curve, instead of struggling to meet evolving regulations. Connected systems make compliance easier as data can be consistently verified, tracked, and accessed when needed.

What we can predict is that more and more insurers will improve their systems so they can be in a better position to adapt to non-negotiable regulatory changes and avoid costly compliance risks. Moving from what might seem as an operational challenge to having a competitive advantage.

How to achieve effective system integrations in insurance

Well-developed APIs (Application Programming Interfaces) are the key to successful integration. They act as digital bridges that connect different software systems into one ecosystem with the goal of enabling seamless data flow and communication.

Creating robust, scalable APIs

Think about APIs as the enablers of integration. To stand the test of time, they shouldn't just solve today's requirements, They should be scalable, flexible and built with the future in mind. Why is that? Because as the insurance industry evolves, APIs must evolve with it.

Well-designed APIs are typically RESTful, secure, and with even-listening mechanisms. Another critical aspect of great APIs is comprehensive documentation. It’s the difference between developers spending hours troubleshooting or integrating with ease.

To create APIs that adapt to the future demand, keep these key considerations in mind:

|

Key considerations |

What to do |

Why it matters |

|

Scalability |

Ensure the API can handle increasing data loads and support new technologies as they emerge. |

Supports growth and ensures the API can meet future demands without system overhauls. |

|

Flexibility |

Design APIs to accommodate different data formats and systems for seamless integration. |

Facilitates integration with diverse systems and future-proofing against technology changes. |

|

Security |

Implement encryption, authentication, and authorization protocols to protect sensitive insurance data. |

Protects sensitive customer and business data, building trust and meeting compliance requirements. |

|

Event listening |

Enable real-time notifications or triggers for system events. |

Improves responsiveness of the system. |

|

Documentation |

Create comprehensive documentation for developers. |

Reduces development time and errors, and it enables faster and more efficient future integrations. |

|

Testing and Monitoring |

Include rigorous testing and ongoing monitoring tools to identify and resolve issues quickly. |

Ensures reliable operation and user experience by identifying and fixing issues proactively. |

|

Standardisation |

Align with industry standards like Blueprint 2 in the insurance market to ensure compatibility with other systems. |

Enhances interoperability, making it easier to connect with partners and meet industry standards. |

Selecting third-party solutions with quality APIs

With every new software that's introduced into the organisation, insurers should evaluate the quality of the API provided by that solution. Does it fit seamlessly into the existing ecosystem? Are there any compatibility issues? Is the solution well-documented? Is it scalable?

Since the quality of the APIs affects both short-term implementation and long-term functionality, it’s essential to prioritise answering these questions when choosing off-the-shelf solutions.

If your team doesn't have the capacity to manage this complex process, look for vendors who understand the importance of integration. And not only that, find partners who are committed to supporting your technical team every step of the way.

What our partners from Whitespace have to say

Based on Whitespace's extensive expertise, three foundational capabilities must be established for the specialty insurance market to truly thrive:

- A placing platform: A central platform where the data within the risk is negotiated and agreed by all parties. Manual re-key from upstream and into downstream systems can only be avoided once consistency is obtained in the centre.

- A mechanism to capture the structured data explicitly: As part of the placement workflow, e.g. Class of Business, Inception Date, Expiry Date, Limits etc. Explicit data entry directly into the contract is a superior approach to AI-driven data extraction. This is because the extraction and/or human checks may introduce errors, and human intervention also prevents seamless automation.

- A comprehensive set of APIs: With a mechanism to listen to events on the placing platform and trigger these APIs: to access structured data within the risk (both read and write) and pass information between systems, and to trigger workflows, so that processes can be automated.

Future-proof your business with the right partner

As you can see many insurance companies are standing at the crossroads, they either need to evolve, or risk being left behind.

At Vega IT, we understand the challenges and opportunities of integrating systems in the insurance industry. We are proud to be Whitespace’s only delivery partner, undergoing comprehensive training on both the platform and its integration capabilities.

With successfully completing more than 300 complex integrations, we know that we have what it takes to help you unlock new business opportunities.

Ready to take the next step? Reach out to us today.